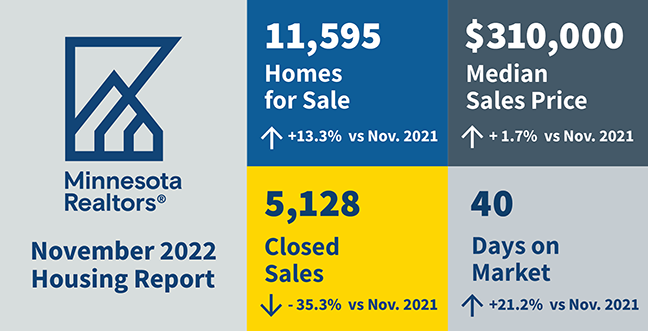

I am sharing this article today because it resonates so well with me. If you talked with me recently, you have heard me speak to this almost exactly. We keep comparing our market to last year, which was an anomaly. 2020 and 2021 were years we exceeded so many milestones that will likely not replicate itself again. It was a result of the current economy at the time and the pandemic and had us growing 20-30% in both years.  So, what if it slips a little now? You’re likely still going to be up massively from when you bought it, as long as you didn’t buy it in the last 2 years. We had years of steady growth long before the pandemic, and it’s important to realize that this current real estate market is strong and sustainable. To the left is the Minnesota market November numbers. It tells the same story.

So, what if it slips a little now? You’re likely still going to be up massively from when you bought it, as long as you didn’t buy it in the last 2 years. We had years of steady growth long before the pandemic, and it’s important to realize that this current real estate market is strong and sustainable. To the left is the Minnesota market November numbers. It tells the same story.

In a nutshell, don’t get your advice from the evening news. It’s a bunch of unnecessary hype that will cost you thousands of dollars, missed opportunities and lost time. If you want to buy, then buy. If you want to sell, then sell. And when is the best time to buy or sell? When you are ready, it’s never too early to start planning so contact me for any questions or help analyzing your current situation.

Great read below!

Two Key Charts to Contextualize the U.S. Housing Market

Media headlines are focused on a crashing U.S. real estate market, but the truth is more nuanced with less hyperbole.

Context matters: The reality is that the market is down, but simple comparisons to a sky-high 2021 are amplifying the scale of the decline.

-

Arm yourself with the right data — two key charts — to understand and contextualize this dynamic market.

Monthly home sales are collected and published by the National Association of Realtors (NAR), but historical data beyond 2021 is not easily accessible and rarely included in analyses.

-

With help from NAR, I’ve published this data in the past — and now I’m publishing a direct link to a live chart: U.S. Existing Home Sales.

While existing home sales are down in the second half of 2022, the deviation from historical averages is not nearly as extreme as the drop from last year.

Looking forward: A leading indicator for the future housing market is consumer demand for mortgage loans (specifically purchase loans).

-

This mortgage application data, alongside average mortgage rates, is published weekly by the Mortgage Bankers Association.

The mortgage demand index shows that purchase demand is at record lows — but just barely (compared to 2014).

-

Furthermore, there is a recent uptick in demand that corresponds to dropping mortgage rates.

The bottom line: The last six months of 2022 have been challenging, and it appears likely that low volumes will continue well into 2023.

-

But it’s not as bleak as the news headlines may lead you to believe.

-

Do your own research and make your own conclusions — with the right data: U.S. Existing Homes Sales and Purchase Mortgage Demand are a great start.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link